preferred fixed pricing period pag ibig|(Updated!) PAG : Bacolod Actual loanable amount may vary depending on Pag-IBIG Fund’s validation and evaluation. Fixed pricing period is how long you want to lock-in your chosen rate. What do supplementary numbers mean in Oz Lotto results? These are the three extra numbers that are drawn after the seven main numbers. Out of the seven jackpot divisions, three include the supplementary number for extra winnings. This number acts as a significant boost to your correct main number guess if you have already .

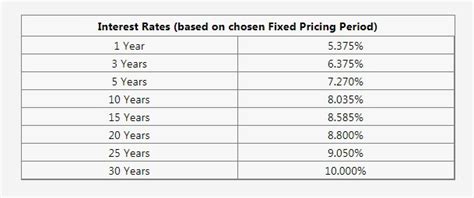

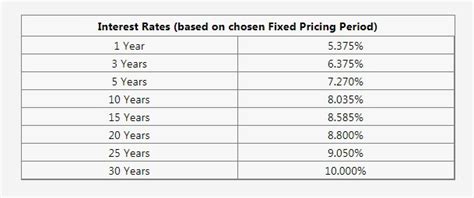

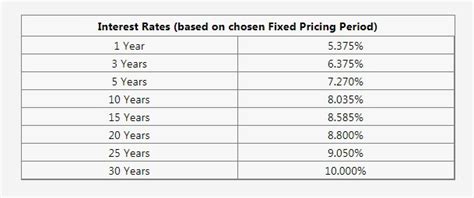

preferred fixed pricing period pag ibig,Hul 29, 2017 — Repricing period, also referred to as cycle, tenor, or fixing period, is the period for which the interest indicated will apply. After this period interest rates will be repriced, to either go up or down depending .By choosing your preferred fixed pricing period (1-30 years), you get to protect yourself against fluctuations and also decide how long this protection will last.Actual loanable amount may vary depending on Pag-IBIG Fund’s validation and evaluation. Fixed pricing period is how long you want to lock-in your chosen rate.Actual loanable amount may vary depending on Pag-IBIG Fund’s validation and evaluation. Fixed pricing period is how long you want to lock-in your chosen rate.Ene 31, 2024 — PAG-IBIG HOUSING LOAN INTEREST RATES – Here is a guide on the rates set by the Pag-IBIG Fund based on the fixing period chosen by the borrower. In .At the end of the 5-year or 10-year period, the interest rate shall be repriced based on the prevailing interest rate in the Fund's Full Risk-Based Pricing (FRBP) Framework.

Hul 31, 2023 — Select the preferred fixed pricing period. It will fix your interest rate for a specific period before breaking it down into staggered intervals with adjustments every .Hul 9, 2024 — Then, utilize the Pag IBIG loan calculator to estimate the amount you can borrow based on your preferred loan amount, repayment period, and fixed pricing period.

Welcome to our Special Housing Loan Restructuring Program page. Under this program, you are given the opportunity to renegotiate the terms of your loan and make it easier for .Hul 29, 2017 — Repricing period, also referred to as cycle, tenor, or fixing period, is the period for which the interest indicated will apply. After this period interest rates will be repriced, to either go up or down depending on economic factors prevailing at .By choosing your preferred fixed pricing period (1-30 years), you get to protect yourself against fluctuations and also decide how long this protection will last.

(Updated!) PAGActual loanable amount may vary depending on Pag-IBIG Fund’s validation and evaluation. Fixed pricing period is how long you want to lock-in your chosen rate.Actual loanable amount may vary depending on Pag-IBIG Fund’s validation and evaluation. Fixed pricing period is how long you want to lock-in your chosen rate.Set 12, 2020 — What is “fixed pricing period” in PAGIBIG’s housing loan? The “fixed pricing period” is how long you want to lock-in the interest rate of your loan. This means the interest rate will not change or won’t be “repriced” .Ene 31, 2024 — PAG-IBIG HOUSING LOAN INTEREST RATES – Here is a guide on the rates set by the Pag-IBIG Fund based on the fixing period chosen by the borrower. In the Philippines, one of the most popular housing loans is the Pag-IBIG Housing Loan which is offered by the Pag-IBIG Fund to qualified members.

At the end of the 5-year or 10-year period, the interest rate shall be repriced based on the prevailing interest rate in the Fund's Full Risk-Based Pricing (FRBP) Framework.Hul 31, 2023 — Select the preferred fixed pricing period. It will fix your interest rate for a specific period before breaking it down into staggered intervals with adjustments every two years according to prevailing rates.Hul 9, 2024 — Then, utilize the Pag IBIG loan calculator to estimate the amount you can borrow based on your preferred loan amount, repayment period, and fixed pricing period.

Welcome to our Special Housing Loan Restructuring Program page. Under this program, you are given the opportunity to renegotiate the terms of your loan and make it easier for you to pay your Pag-IBIG Fund Housing Loan. This is part of our efforts to help you during these challenging times.

Hul 29, 2017 — Repricing period, also referred to as cycle, tenor, or fixing period, is the period for which the interest indicated will apply. After this period interest rates will be repriced, to either go up or down depending on economic factors prevailing at .preferred fixed pricing period pag ibig (Updated!) PAGBy choosing your preferred fixed pricing period (1-30 years), you get to protect yourself against fluctuations and also decide how long this protection will last.preferred fixed pricing period pag ibigActual loanable amount may vary depending on Pag-IBIG Fund’s validation and evaluation. Fixed pricing period is how long you want to lock-in your chosen rate.Actual loanable amount may vary depending on Pag-IBIG Fund’s validation and evaluation. Fixed pricing period is how long you want to lock-in your chosen rate.Set 12, 2020 — What is “fixed pricing period” in PAGIBIG’s housing loan? The “fixed pricing period” is how long you want to lock-in the interest rate of your loan. This means the interest rate will not change or won’t be “repriced” .

Ene 31, 2024 — PAG-IBIG HOUSING LOAN INTEREST RATES – Here is a guide on the rates set by the Pag-IBIG Fund based on the fixing period chosen by the borrower. In the Philippines, one of the most popular housing loans is the Pag-IBIG Housing Loan which is offered by the Pag-IBIG Fund to qualified members.

At the end of the 5-year or 10-year period, the interest rate shall be repriced based on the prevailing interest rate in the Fund's Full Risk-Based Pricing (FRBP) Framework.Hul 31, 2023 — Select the preferred fixed pricing period. It will fix your interest rate for a specific period before breaking it down into staggered intervals with adjustments every two years according to prevailing rates.

preferred fixed pricing period pag ibig|(Updated!) PAG

PH0 · What is a fixed pricing period?

PH1 · Understanding Pag

PH2 · Pag

PH3 · PAG IBIG House Renovation Loan (Requirements

PH4 · Modified Guidelines on the PAG

PH5 · Loan Status Verification

PH6 · HL Restructuring Application

PH7 · (Updated!) PAG